Youll pay a late filing penalty of 100 if your tax return is up to 3. 30042022 15052022 for e-filing 5.

Deepak Chauhan Assistant Legal N Tax Advisory Llp Linkedin

31032022 30042022 for e-filing 4.

. The original electronic filing for Tax Year 2019 or Tax Year. Exemption us 11 - charitable activity - We fail to understand as to how any university which has been set up under the UGC Act could grant affiliation for coaching classes which are nowhere part of commissions standards. Gift is more than Rs50000- me my father both filing our income tax return.

Form B Income tax return for individual with business income income other than employment income Deadline. Pays for itself TurboTax Self-Employed. Faced with this situation we are of the opinion that the learned Assessing Officer needs to factually verify all the assessees evidences afresh and treat it.

Can I Amend My 2019 Tax Return In 2020. Youll get a penalty if you need to send a tax return and you miss the deadline for submitting it or paying your bill. Wrong info regarding disabled child.

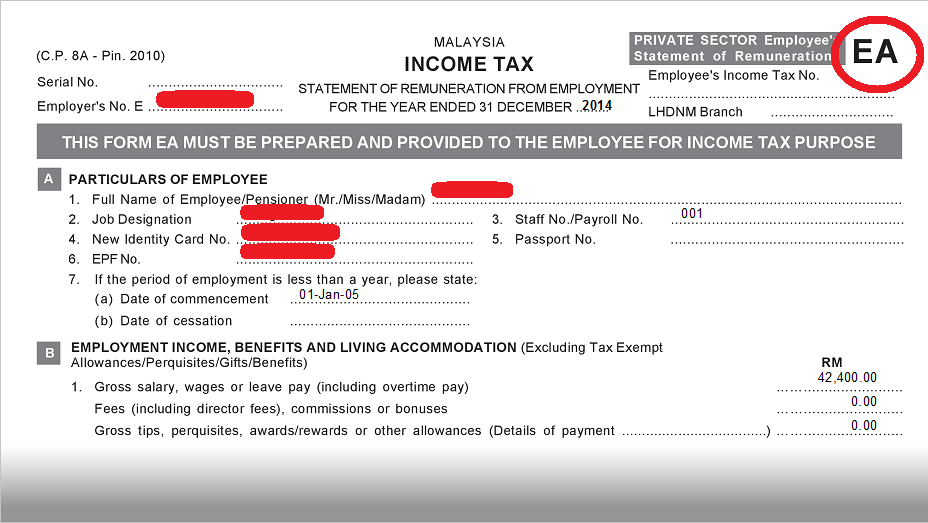

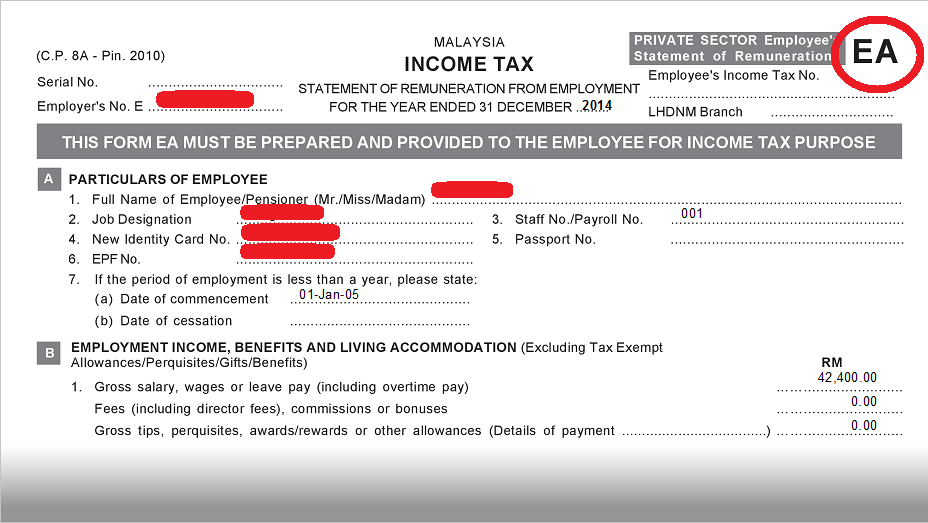

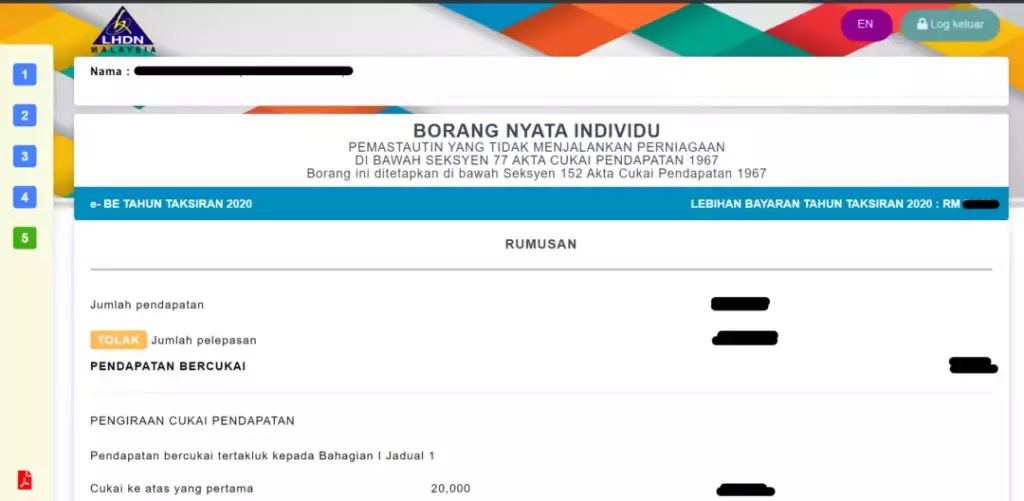

Know the Tax Slab for TaxPayers under 60 years of age Senior Citizens and Super Senior Citizens under the New and Old Regime. Form BE Income tax return for individual who only received employment income Deadline. A step-by-step guide with everything you need to know about filing your income tax returns form for Malaysia income tax 2020 year of assessment 2019.

November 23 2016 at 1254 pm. September 6 2016 at 953 am. The income tax deadline is usually on April 30 manual submission or May 15 e-Filing so you could set it some time at the start of April to give yourself extra time if anything goes wrong.

The deadline for filing income tax in Malaysia is 30 April 2020 for manual filing and 15 May 2020 via e-Filing. Safety is an important consideration for all of us. 30062022 15072022 for e-filing 6.

Here are 10 things you should know about the Updated ITR filing. However this might attract the tax enquiry but dont worry if you have not done anything wrong. Print your e-form and make corrections in the wrong space a brief.

If filed after March 31 2022 you will be charged the then-current list price for TurboTax Live Full Service Basic and state tax filing is an additional fee. The system allows only amendments to Forms 1040 and 1040-SR for tax years 2019 and 2020. Estimates based on deductible business expenses calculated at the self-employment tax income rate 153 for tax year 2020.

Filing income tax can be a long and. Actual results will. Check income tax slabs and tax rates in India for FY 2021-21.

In the form for Updated ITR taxpayers are required to declare the purpose for filing as well as the amount of income to be. This article pertains to income tax filing for the year of assessment 2019. Find all of the tax reliefs tax deductions and tax rebates for filing your Malaysia personal income tax 2020 for the year of assessment 2019.

7 Common Income Tax Filing Mistakes To Avoid Mypf My

Income Tax Notice Top 8 Reasons Why You May Get One Eztax

7 Common Income Tax Filing Mistakes To Avoid Mypf My

Income Tax Return 2019 Compulsory Mention Of Aadhaar In Itr The Financial Express

What Happens When Malaysians Don T File Their Taxes Update

Step By Step Income Tax E Filing Guide

What Happens When Malaysians Don T File Their Taxes Update

7 Common Income Tax Filing Mistakes To Avoid Mypf My

Common Pitfalls To Avoid In Ya 2021 Corporate Income Tax Filing Ey Singapore

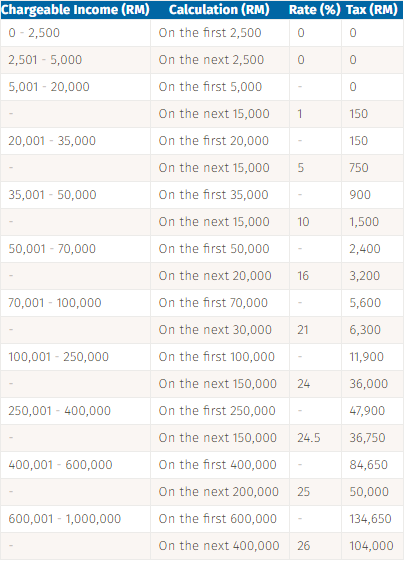

Beware Of Tax Scams Lembaga Hasil Dalam Negeri Malaysia

How To File Your Income Tax In Malaysia 2022 Ver

Penalties For Income Tax Evasion And Offences In Malaysia

What Happens When Malaysians Don T File Their Taxes Update

How To File Your Income Tax In Malaysia 2022 Ver

What Happens When Malaysians Don T File Their Taxes Update

7 Common Income Tax Filing Mistakes To Avoid Mypf My

Penalties For Income Tax Evasion And Offences In Malaysia

How To Re Submit Your Income Tax Form If You Did It Wrong Malaysia Financial Blogger Ideas For Financial Freedom